Jerry H.

Dollar Cost Averaging is CRAP!

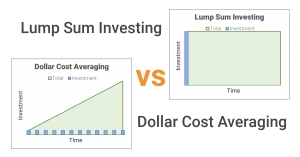

Dollar cost averaging (DCA) is a type of investment strategy where an investor will make constant dollar amount contributions to an investment at regular intervals. This theoretically reduces the risk and smooths out your purchase price over the course of time that you are contributing. The idea is that you are buying more shares of an investment when the price is low, and less shares when the price is high. I will show you that Lump Sum investing is superior to DCA investing using historical data of the S&P 500.

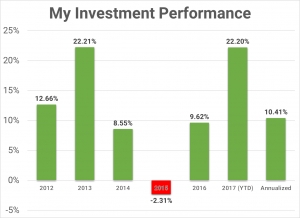

How to calculate your internal rate of return using Google Sheets

The internal rate of return (IRR) is the dollar-weighted return of a particular investment. It is what I consider to be gold standard measurement of your investment's personal performance. The calculation for IRR looks like a pain in the ass. Luckily, there is a spreadsheet function that calculates this easily for you, and I just so happen to be awesome at creating spreadsheets.

How diversifying your asset allocation smooths out the ride - a real life example

I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

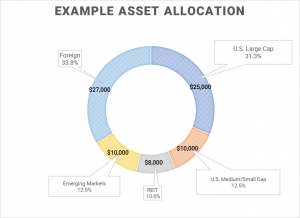

Achieving your target asset allocation across multiple accounts and investment vehicles

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!

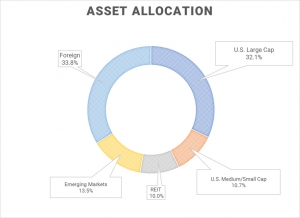

How to choose a target asset allocation for your investments

When it comes to choosing asset classes in your investment portfolio, most of us know that diversification leads to a better return vs risk profile by reducing volatility without sacrificing returns. That is the premise of investing in index funds instead of picking individual stocks. However, even among different index funds, depending on the asset class they represent, there can be high volatility as well (think emerging market or small cap funds). Thus, it is also important to diversify across different asset classes. I will show you my own personal asset allocation and how I decided on it.

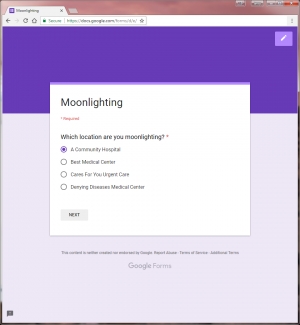

Life Hacks - a scheduling tool for adding work shifts onto your Google calendar

Do you ever get tired of manually putting in work shifts onto your calendar? Do you work a sporadic schedule where you often have multiple shifts a month, but the days are not neatly arranged? Do you moonlight a lot, like I do,and need an easy way to put all those shifts onto your calendar? If so, continue reading to learn about how I solved this problem for myself. I can even help you do the same.

How I increased my moonlighting income from a few thousand dollars a year to six figures!

This is the story of my moonlighting journey for the past five years. It included a lot of hustling to find more shifts, a manageable workload, and better paying jobs. How much can you make moonlighting as a physician in training? In the past five years, I went from making a few thousand dollars a year to breaking six figures. Read more to find out my strategies and how you can do the same.

Why I preferentially choose 1099 income over W-2 income

Having 1099 income in addition to W-2 income provides you with a lot of flexibility in terms of retirement accounts and tax deductions. Prior to diving deeper into this topic let me explain that I do already have a day job that is W-2 income and provides all the benefits you would expect, including health and disability insurance, retirement benefits, etc. My preference in choosing 1099s over W-2s is with regards to additional income outside of my day job.

What are the tax implications of receiving 1099 income?

Just as a refresher, W-2 income is generally the payment type when you are an employee while 1099 is the payment type when you are an independent contractor. The fundamental difference between receiving 1099 income and W-2 income in the purview of the federal government is the distinction between being employed or self-employed. There are some major differences in tax calculations and how taxes are paid, which I plan to discuss in the rest of this post.

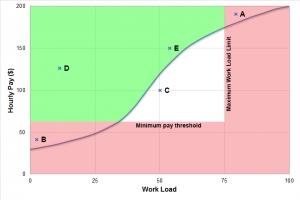

What are my considerations when choosing a moonlighting job?

I have a reputation among the residents and fellows at my hospital as being a moonlighting guru -- I think the reason is that they hear that I moonlight a lot, so they think I must know a lot about it! They often ask me for advice on how to get started and what I look for in a moonlighting gig, so I decided to write this post describing my thought process when evaluating a moonlighting gig.