I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

Our Investment Portfolio

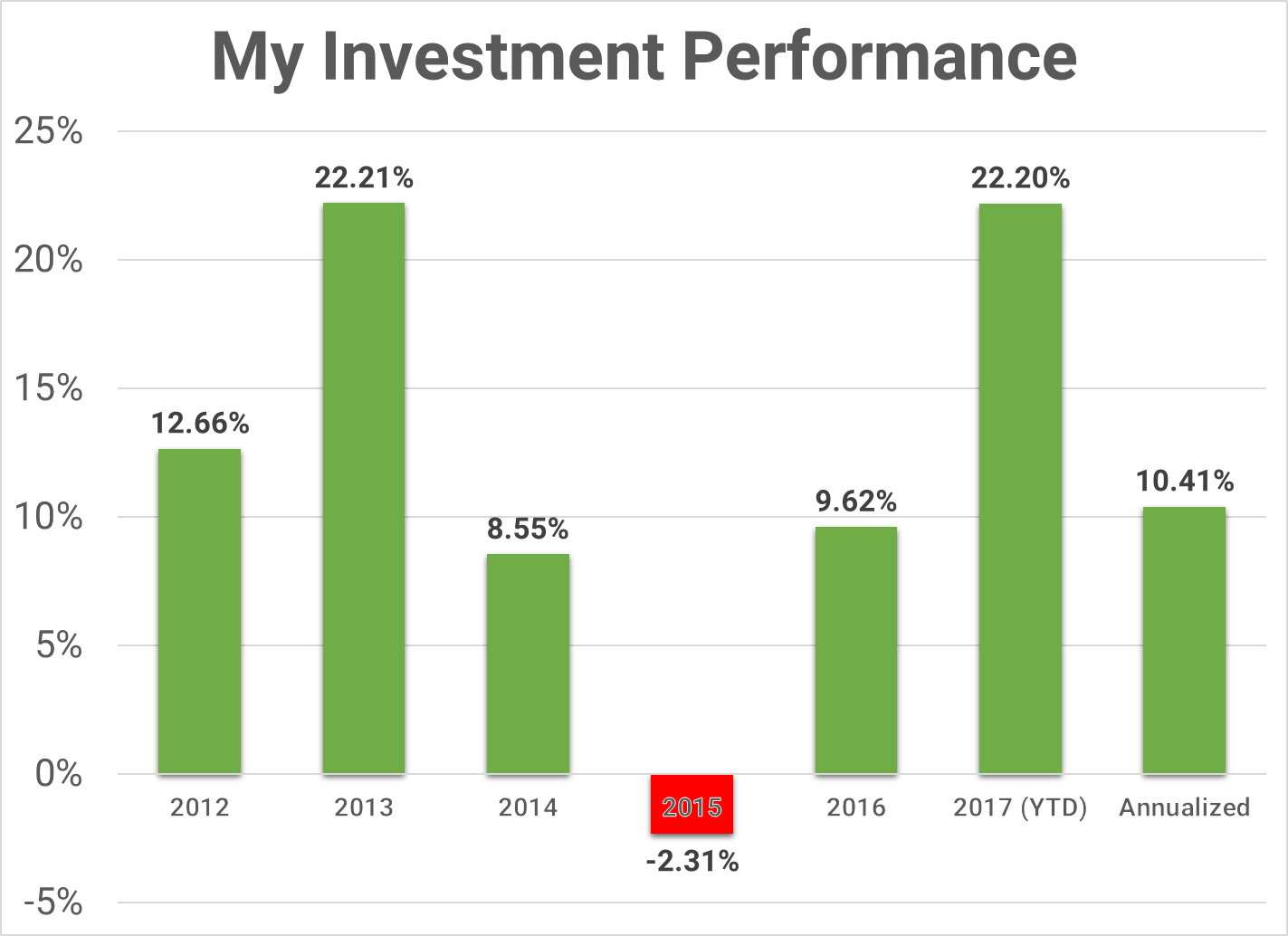

Above is a graph of all of my wife and my investment account's annual internal rate of return since inception (except for a RobinHood brokerage account in which I pick stocks for fun). At the far right is the annualized performance over the past six years. I determine the performance by calculating the internal rate of return (IRR) which is a dollar-weighted return of the investment. It is heavily influenced by the price at which I buy an investment which, in my opinion, is the only way I should calculate my return. It also includes dividends as part of my returns, which is not readily apparent if you just look at a fund or stock's price. For more on this topic, check out this article at Morningstar.

Undiversified Portfolios Have High Volatility

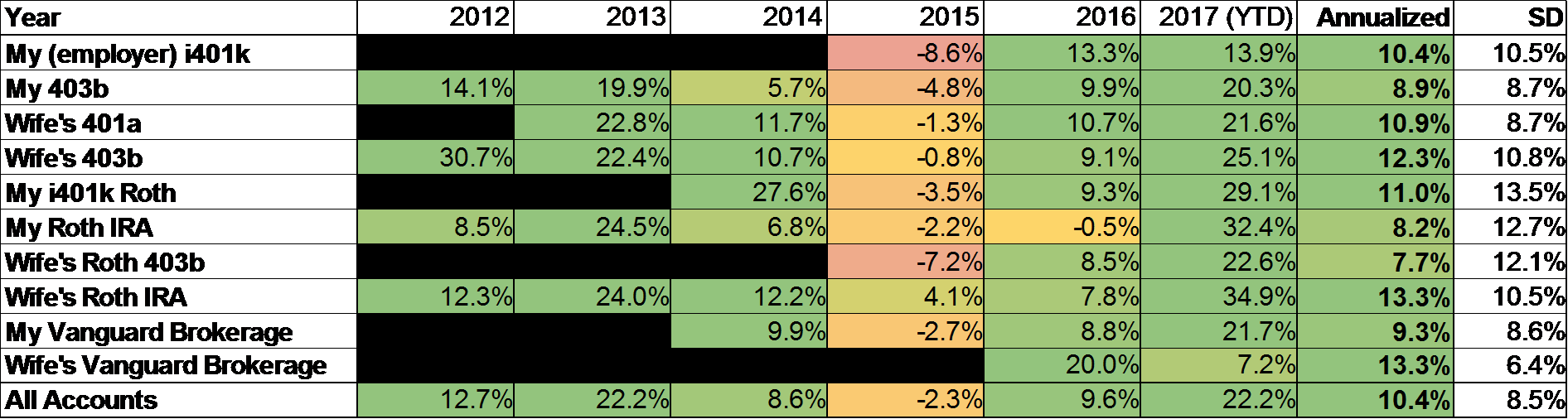

I have listed out all of the accounts that my wife and I have in the chart above. If you scrutinize the performances of each account, you will notice a lot of variation. The most extreme example (confirmed by having the highest standard deviation) is probably my individual Roth 401(k) account. It has ranged from -3.5% to 29.1% annual returns with a standard deviation of 13.5%! In fact, when you take a look at the standard deviations of each of our accounts, they range from 6.4% - 13.5%; however, the median is 10.5% and the average 10.3%. Now if I take the standard deviation across the yearly returns of all of our accounts combined, it decreases to 8.5%! Only ONE of the individual accounts had a lower standard deviation than that.

Diversification Leads to Lower Volatility and Similar Returns

Of course we should also investigate whether the return is compromised as a result of reducing risk. The annualized returns ranged from 7.7% to 13.3% with a median of 10.6% and a mean of 10.5%. Here is my interpretation -- at best I could get a 13.3% return if I put all my investments into the best asset, but I have no way of predicting which fund is the best. By gambling on one fund, my expected value for return would be the median or mean of around 10.5%.

My true annualized return was 10.4%, which is essentially no different than the above scenario, with much less risk and volatility.

I hope I have shown you that diversification into multiple asset classes will reduce variability and risk WITHOUT sacrificing performance!