Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!

So Many Investment Vehicles!!!

Between my wife and I, we have over a dozen different investment vehicles, listed below with branching as follows: tax type >> account >> investment vehicle.

Me |

My Better Half |

|

Pre-Tax

Post-Tax

Taxable

|

Pre-Tax

Post-Tax

Taxable

|

That is A LOT of investment vehicles. Chances are, anybody who's been working for five or more years has just as many.

There are basically two general ways you could get to your target asset allocation:

- Each investment vehicle strives to match the target asset allocation within itself, or

- The combined asset allocation of all accounts strives to match the target asset allocation.

In a prior post on determining your target asset allocation, I mentioned you could easily simplify your target asset allocation into one fund, or three funds. If you choose to do that, then option number one is likely to be the easier solution. If you, like me, are more specific with your goals and want to fine-tune your asset allocation, then option number one may not be feasible. In theory, number one sounds much easier; however, it actually has some significant limitations.

- Not every investment vehicle, especially employee retirement accounts, will have an index fund that represents your desired asset type.

- Within Vanguard funds, which seem to be the most popular because they often have the lowest expense ratios, there are tiers of index funds of the same type whose only difference is the expense ratio. After exceeding certain threshold amounts, the expense ratio decreases. That being said, unless you have a lot of money in each investment vehicle, then you will not be getting the lowest expense ratio for a particular fund.

- Each investment vehicle has a different tax status, so to put tax-inefficient investments into a taxable account would not be ideal.

I plan to talk about whether it matters which asset class goes into which investment vehicle in another post. For now, we will discuss the tax considerations for balancing across different accounts. In a simplistic approach, we will consider the tax status of post-tax and taxable investments as the same. It is a reasonable simplification since the holdings within the taxable investments will grow the same, so long as you pay the taxes on any dividends and capital gains separately.

An Example of Maintaining Your Target Asset Allocation Across Multiple Investment Vehicles

Lets say you have $100,000 total in investments, of which $20,000 is in post-tax investments, and $80,000 is in pre-tax investments.

| Pre-Tax | Post-Tax |

| $80,000 | $20,000 |

The important tax consideration is that anything in a pre-tax investment will eventually be taxed at your ordinary income rate when you withdraw it in retirement. You will need to make an educated guess on what you think this will be in the future. In my case, I used a taxation of 25%. Your EFFECTIVE pre-tax balance, after taxes is $60,000. You should use your EFFECTIVE balances to achieve your target asset allocation.

| Effective Pre-Tax | Taxes | Post-Tax |

| $60,000 | $20,000 | $20,000 |

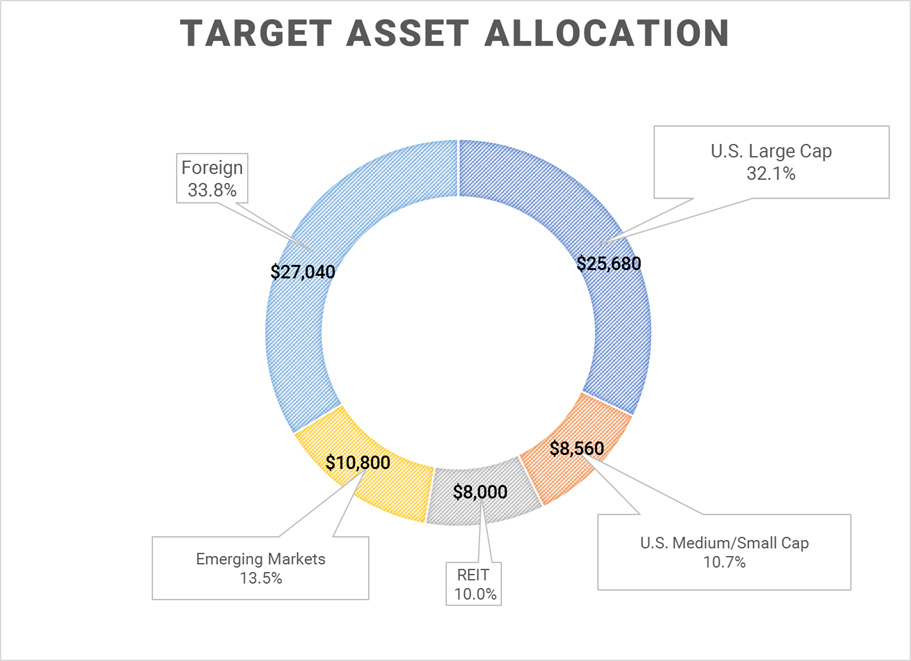

Lets try to achieve the same asset allocation as my personal goal, which correspond to the following effective balances for each:

On an $80,000 effective total balance, your goal effective balance for each is shown in the list below. Lets also say we have the following accounts which we will just refer to by number with the corresponding EFFECTIVE balances (real balance x 0.75):

| Effective Pre-Tax | Taxes | Post-Tax | ||||

| $60,000 | $20,000 | $20,000 | ||||

| 1 | 2 | 3 | 4 | 1 | 2 | |

| $10k | $15k | $15k | $20k | $10k | $10k | |

You will quickly learn that you cannot exactly match your desired allocation. This is partially because there are minimum investment amounts for each index fund (usually $3,000), but don't sweat it! When deciding which asset class to put into an account, I try to follow these rules in this order:

- Minimize the number of accounts that an asset class spans.

- Minimize the number of funds in each account.

- Don't sweat it if you cannot get your exact desired allocation. Close is good enough.

- Put tax-efficient assets into taxable accounts (Advanced)

Based on these rules, we can put these asset types and balances into the same accounts above:

Pre-Tax - $60,000 |

Post-Tax - $20,000 |

|

|

Don't forget that we had converted to effective balances, so you will need to convert your pretax balances back to their actual amounts by undoing the 25% effective tax rate (divide by 0.75):

Pre-Tax - $80,000 |

Post-Tax - $20,000 |

|

|

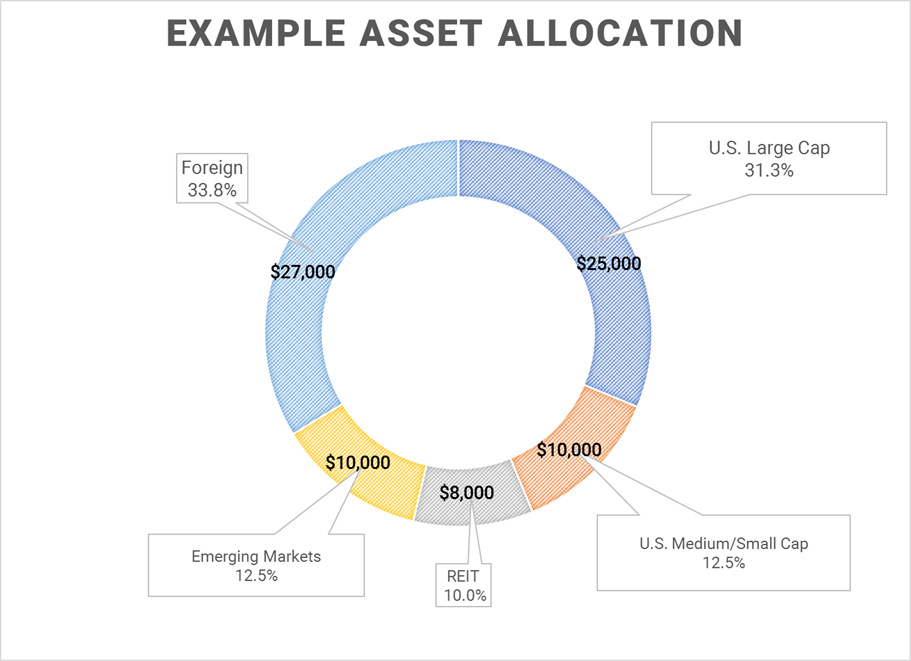

And that's it! It's not too bad, and if you make it in a spreadsheet, it can be calculated quite easily. Here is what the resulting asset allocation looks like:

It is pretty close to the target asset allocation, and close is good enough! I hope this was helpful in helping you figure out how to achieve your target asset allocation. I'd love to hear about your target allocation and how you came up with it below!