When it comes to choosing asset classes in your investment portfolio, most of us know that diversification leads to a better return vs risk profile by reducing volatility without sacrificing returns. That is the premise of investing in index funds instead of picking individual stocks. However, even among different index funds, depending on the asset class they represent, there can be high volatility as well (think emerging market or small cap funds). Thus, it is also important to diversify across different asset classes. I will show you my own personal asset allocation and how I decided on it.

How many asset types should you own?

As I see it, you can include as little or as many asset types as you would like and it wholly depends on how specific you want your asset allocation to be. It is totally adequate to just use one fund for all of your investment accounts. Here are two perfectly good buckets of funds to represent your entire portfolio:

- One Fund

- Target Retirement Index Fund or Life-Cycle Fund

- Three (+1 Optional) Funds

- Total Stock Market Index Fund

- Total International Stock Market Fund

- Total Bond Market Index Fund

- Total International Bond Market Index Fund (Optional)

If you choose one fund, you can just pick the year you plan to retire, and the fund will automatically adjust its holdings to take on fewer risks as you approach that date. For the three (+1) fund approach, you may choose each based on your risk profile. The Vanguard Target Retirement Funds are basically using these four funds an in increasingly higher Bond proportion as you reach retirement age. A general rule of thumb is that you should hold onto a percentage of equities that is equal to 120 minus [your age]. If you are 30 years old, then you should hold 90% equities. However, I made a slightly more detailed asset allocation because I have specific goals and because I just love thinking about it. I do this by categorizing asset types into 7 different categories:

- Bond (BND/VBTLX)

- Equity - REIT (VNQ/VGSLX)

- Equity - U.S. Large Cap (VOO/VFIAX)

- Equity - U.S. Medium/Small Cap (VXF/VEXAX)

- Equity - Foreign Developed Markets (VEA/VTMGX)

- Equity - Emerging Markets (VWO/VEMAX)

- Cash Equivalents (VTIP/VTAPX)

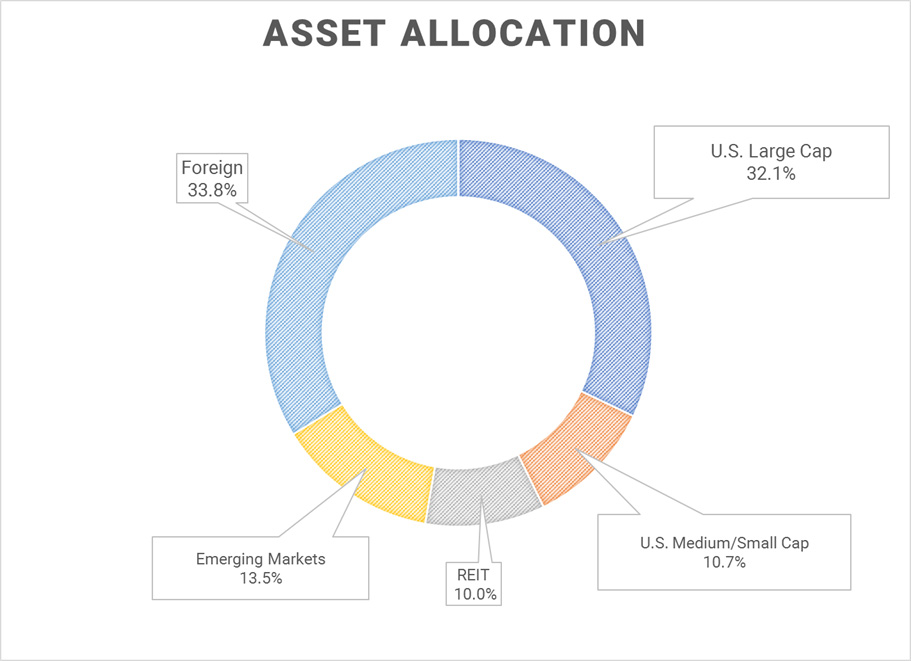

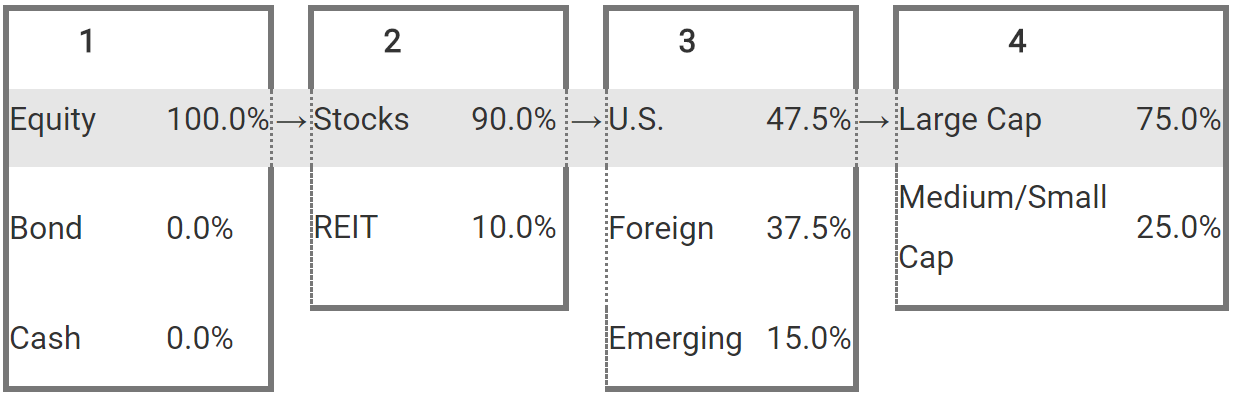

In the above list I have assigned a representative index ETF and fund for each asset type. I personally use Vanguard funds due to their low fees. I also have a relatively high risk tolerance and a long timeline, so I chose to separate out U.S. Medium/Small Cap stocks and Emerging Markets so that I can preferentially increase my holdings in those asset classes. Here are my calculations to figure out my final desired allocation.

I will explain each decision along this decision tree:

- Because of my higher risk tolerance and long time horizon, bond and cash equivalents as investment assets are not desirable to me, and so I avoid them completely.

- I currently own zero real estate properties, so putting 10% into REITs is my way of diversifying into real estate. When I do invest in real estate in the future, then I will pull out of this fund.

- If you look at the world breakdown of market capitalization, North America represents just 40.6%. This is mostly represented by the US, but the point remains that the US does not represent the majority of the world's market. For diversification, you would want a good representation of foreign equities in addition to domestic equities. Because I am living in the U.S., I slightly overweigh the U.S. at 47.5%. As for choosing between Foreign and Emerging markets, once again I have a high risk tolerance and am looking for more growth so I overweigh Emerging equities.

- Medium and Small cap equities have a higher potential for growth albeit with a greater risk. For the same reasons above, I overweigh Medium/Small Cap stocks.

A Look At My Asset Allocation

Here is what my goal asset allocation looks like after using the previous calculations. Each person should assess their own risk tolerances and modify accordingly. Alternatively, for those that are not tweakers, you may stick to a simpler asset allocation as mentioned before. The important thing after creating a goal is to stick to it, and periodically re-evaluate it to make sure it is still in line with your goals as your situation changes. As I get older, I am sure I will be moving things from higher volatility to lower volatility asset classes.

Most people will probably have multiple investment accounts across different investment vehicles, each with a different tax status. How do you achieve your asset allocation across different accounts? Keep following the Delayed Earner for a post on this subject in the future.