From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation.

I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay period. Your goal should be to have your total combined withholdings match your tax liability for the year as closely as possible, unless you are very financially disciplined. More on that in another post about owing vs. receiving money when you file federal taxes.

First, I would like to provide a disclaimer that I am not a CPA or a tax professional. If you require professional assistance, I recommend you hire an accountant to help you with your specific situation. Now, for the purposes of this article, I am making the following assumptions:

- Your filing status will be 'Single'

- You have no dependents

- Your salary will be your only source of income

You can still apply the concepts discussed below to your situation whether you are married, head of household, etc. Just be sure to adjust the calculations accordingly.

Filling out the W4

Many coworkers that I talk to do not realize that the W4 form merely provides a guideline for estimating the amount to withhold from your paycheck. I have provided an image of the W4 worksheet above. As you can see, it describes what you may consider personal allowances in sections A-H. The more allowances you put down, the less money is taken from your paycheck. What many people do not know is that you can put ANY number of personal allowances you so choose. What matters at the end is that you withhold enough taxes along the way to avoid penalties, and you pay your entire tax liability whether through any combination of withholdings, estimated tax payments, or a lump sum payment when you file your taxes. But how do you know how much taxes you will owe, and why does the amount you specificy in withholdings matter?

Your tax liability

Like most physicians just finishing medical school, you are starting internship around July 1, and your salary on average is $50,000. To determine your tax liability, lets punch this into a tax calculator at NerdWallet.com:

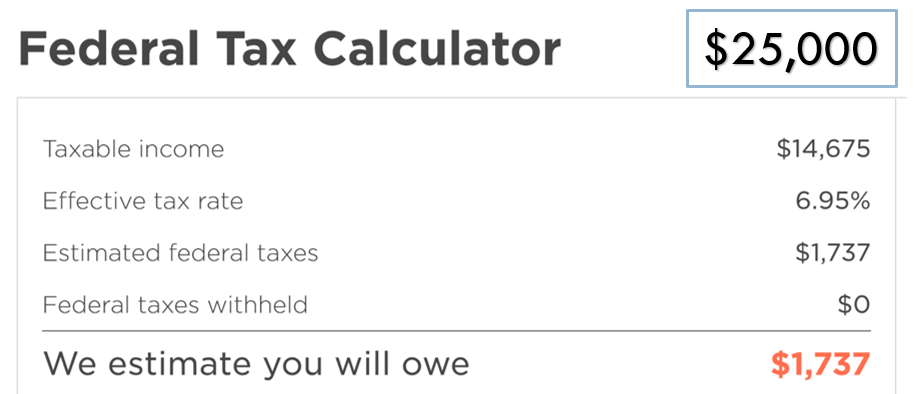

Now if you set up your tax withholdings based on the allowances suggested, you will probably withhold an amount from your paycheck that will get you to this total over the course of one year. However, you are only getting paid for half the year, so your withholdings are half that, at $2,845. Did anybody catch the fallacy of calculating taxation on $50k??? If not, here it is -- since you are only working for half of that first year, you will only owe taxes on $25,000 of income! Your effective tax rate is much lower than someone who made $50,000 for the year. Plugging $25k back into the tax calculator at NerdWallet.com:

Between withholding $2845 and $1737 is a difference of $1,108! I am sure you could use that money for paying down loans, saving an emergency fund, or investing in retirement if it went into your pocket along the way rather than receiving it nearly a year later as a tax refund!! Please, please, PLEASE estimate your tax withholdings properly. A tax refund is NOT free money -- it is an interest-free loan that you gave the federal government by withholding too much from your paycheck!

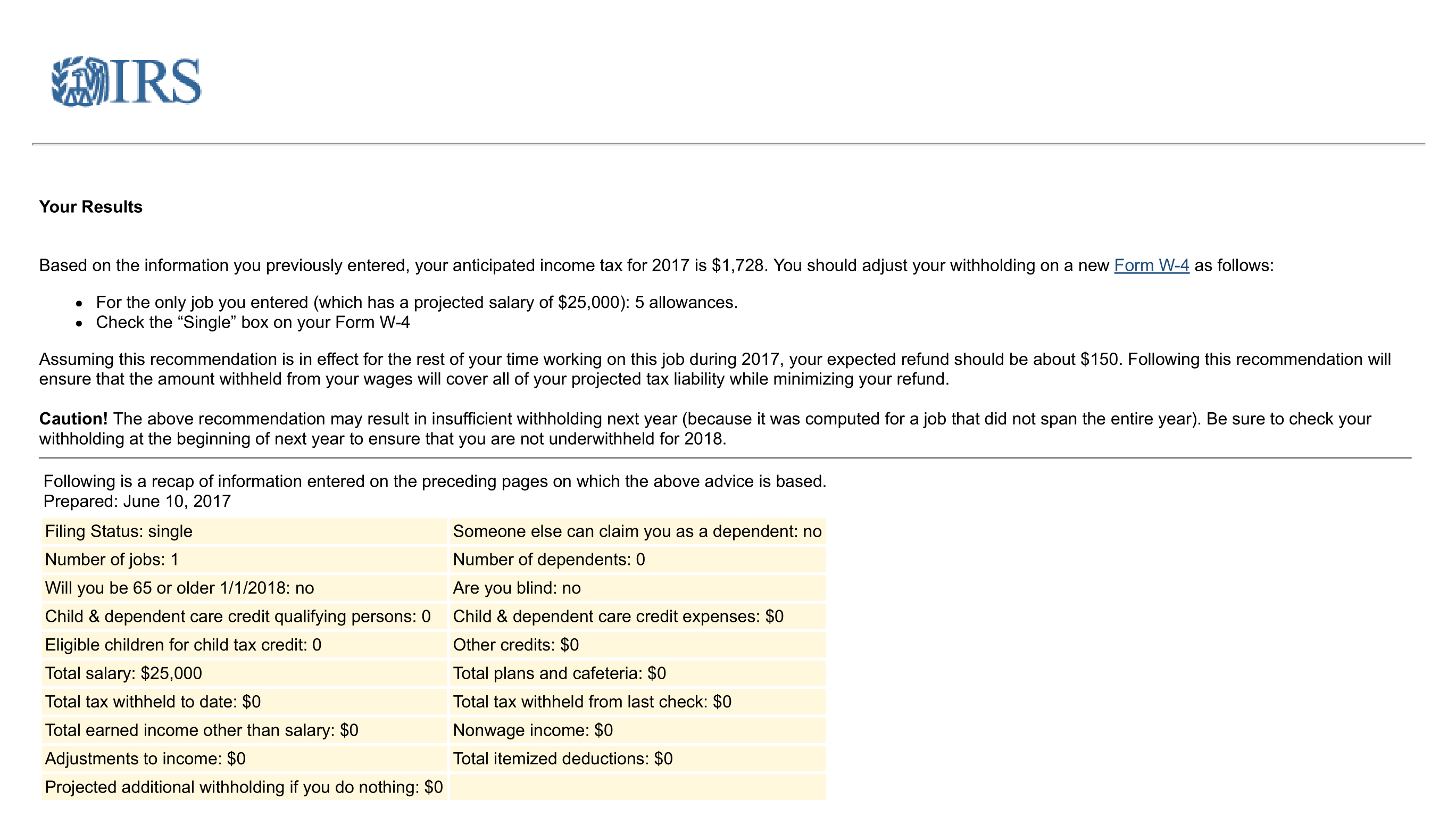

Finally, the important question is how many allowances should you claim? Luckily, the IRS provides a nice calculator just for this purpose:

It suggests FIVE allowances. You would have never known to claim that many based on the W4 instructions. If you are withholding too much, you can submit a new W4 to your employer at any time and change your allowances accordingly to get to your total for the year. Good luck! I would love to hear if you were tricked into claiming one allowance and how much of a tax refund you received. Please leave a comment below!