Jerry H.

Avoiding underpayment penalties for federal taxes - the safe harbor rule

As a proponent of owing federal taxes during filing season as opposed to receiving a refund, I have to be wary to avoid penalties for underpaying taxes along the way. Federal taxes are meant to be a 'pay as you earn' system where you should be "safe harbor" tax law, which are the conditions I need to satisfy in order to NOT owe penalties for underpayment. These can be found in chapter 4 of Publication 505 of the IRS website, which I will describe in more detail in this post.

Introduction to Moonlighting for Physicians

This post is meant to describe what moonlighting is for a physician and why you should do it. It is generally something that can be started during training as a resident, and can continue through fellowship and even as an attending. It will be important to check the terms of your employment to make sure it is allowed. Also, for those in training, be sure to stay within the ACGME duty hours.

Privacy Policy

We use cookies to:

You can choose to have your computer warn you each time a cookie is being sent, or you can choose to turn off all cookies. You do this through your browser settings. Since browser is a little different, look at your browser's Help Menu to learn the correct way to modify your cookies.

Google, as a third-party vendor, uses cookies to serve ads on our site. Google's use of the DART cookie enables it to serve ads to our users based on previous visits to our site and other sites on the Internet. Users may opt-out of the use of the DART cookie by visiting the Google Ad and Content Network privacy policy.

We have implemented the following:

Opting out:

Users can set preferences for how Google advertises to you using the Google Ad Settings page. Alternatively, you can opt out by visiting the Network Advertising Initiative Opt Out page or by using the Google Analytics Opt Out Browser add on.

According to CalOPPA, we agree to the following:

You will be notified of any Privacy Policy changes:

How does our site handle Do Not Track signals?

Does our site allow third-party behavioral tracking?

We also agree to the Individual Redress Principle which requires that individuals have the right to legally pursue enforceable rights against data collectors and processors who fail to adhere to the law. This principle requires not only that individuals have enforceable rights against data users, but also that individuals have recourse to courts or government agencies to investigate and/or prosecute non-compliance by data processors.

To be in accordance with CANSPAM, we agree to the following:

If at any time you would like to unsubscribe from receiving future emails, you can email us at This email address is being protected from spambots. You need JavaScript enabled to view it.

and we will promptly remove you from ALL correspondence.

An argument for owing federal taxes instead of receiving a tax refund

If given the following options, which would you choose? Would you rather...

- offer the federal government an interest-free loan for up to 16 months, or

- receive an interest-free loan from the government for up to 16 months.

The heart of this choice is played out every year, when individuals choose their allowances on their W4 form which determines how much taxes to defer for federal taxes. Withhold more than you owe - you will get a tax refund. Withhold less than you owe - you will have to pay the amount owed. Every year when it comes time to file taxes, I like to ask people whether they owe taxes or are receiving a tax refund. It seems a majority receive a tax refund, and are very happy about it at that! I get it. I get the psychological win, but anyone can set up their withholdings in such a way to receive a tax refund, and in some cases a huge one. But is that the way to go? I do not believe so.

Disclaimer

I have a bachelors in science in chemical engineering and a medical degree. That is it. I have no license or certification in personal finance, law, tax accounting. The advice I provide is from personal experience and from a lot of reading. I am not responsible for any harm that may come to you as a result of you applying my advice.

That being said, I will attempt to be transparent with the information I provide. If, however, you need personalized and professional advice, I recommend you seek out a professional in that area of expertise.

Jerry Hsieh, M.D.

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.

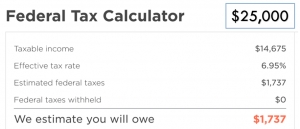

In 2011, when I started residency, the annual contribution limit to my 403(b) was $16,500, and the Roth IRA contribution limit was $5,000. You have until the end of the calendar year to contribute to the 403(b), whereas you have until April 15 of the following year to contribute to the Roth IRA (e.g. you have until 4/15/18 to contribute to 2017's Roth IRA). I wanted to contribute as much to my 403(b) as possible in this short time, with a limited salary. My gross salary for the year was approximately $25k, and I wanted to put $16.5k into my 403(b). That left a gross income of $7.5k, or approximately $6k after tax to live off of for six months. How can one live off of $6k for 6 months with a rent of close $925 a month? Turns out, it is really freaking hard.

How should you fill out the W4 form and think about federal taxes when you start your residency?

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation.

I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay period. Your goal should be to have your total combined withholdings match your tax liability for the year as closely as possible, unless you are very financially disciplined. More on that in another post about owing vs. receiving money when you file federal taxes.

Welcome to DelayedEarner.com

Welcome to my blog, DelayedEarner.com! What is a Delayed Earner, you might ask? Well, in a nutshell, that's me. Allow me to explain. My name is Jerry Hsieh, and I am a physician. I am finishing my fellowship in Pulmonary and Critical Care Medicine, and finally going out into the world to practice independently. Why do I call myself a Delayed Earner? Well, anyone who is familiar with the path of becoming a physician could probably tell you.