Displaying items by tag: taxes

Guide to Opening a Backdoor Roth IRA

What if you are above the income limits to contribute to a Roth IRA? Ugh, right? Mo' money, mo' problems. You can't even get a tax deduction if you contribute to a traditional IRA! Fret not, for all is not lost. You CAN get a Roth IRA, and it's called the Backdoor Roth IRA.

Where should you invest your next dollar?

Saving a lot of money as a Resident because you're not spending 50% of your take-home pay on rent? Making extra money because you're moonlighting like a boss and wondering where to save that extra money? Wondering whether a pre-tax or Roth investment is best to start investing in first? What about paying down loans or investing in the market? I describe how you should prioritize all of that in this post!

Why I preferentially choose 1099 income over W-2 income

Having 1099 income in addition to W-2 income provides you with a lot of flexibility in terms of retirement accounts and tax deductions. Prior to diving deeper into this topic let me explain that I do already have a day job that is W-2 income and provides all the benefits you would expect, including health and disability insurance, retirement benefits, etc. My preference in choosing 1099s over W-2s is with regards to additional income outside of my day job.

What are the tax implications of receiving 1099 income?

Just as a refresher, W-2 income is generally the payment type when you are an employee while 1099 is the payment type when you are an independent contractor. The fundamental difference between receiving 1099 income and W-2 income in the purview of the federal government is the distinction between being employed or self-employed. There are some major differences in tax calculations and how taxes are paid, which I plan to discuss in the rest of this post.

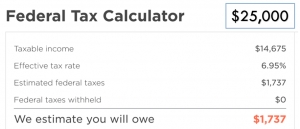

Avoiding underpayment penalties for federal taxes - the safe harbor rule

As a proponent of owing federal taxes during filing season as opposed to receiving a refund, I have to be wary to avoid penalties for underpaying taxes along the way. Federal taxes are meant to be a 'pay as you earn' system where you should be "safe harbor" tax law, which are the conditions I need to satisfy in order to NOT owe penalties for underpayment. These can be found in chapter 4 of Publication 505 of the IRS website, which I will describe in more detail in this post.

An argument for owing federal taxes instead of receiving a tax refund

If given the following options, which would you choose? Would you rather...

- offer the federal government an interest-free loan for up to 16 months, or

- receive an interest-free loan from the government for up to 16 months.

The heart of this choice is played out every year, when individuals choose their allowances on their W4 form which determines how much taxes to defer for federal taxes. Withhold more than you owe - you will get a tax refund. Withhold less than you owe - you will have to pay the amount owed. Every year when it comes time to file taxes, I like to ask people whether they owe taxes or are receiving a tax refund. It seems a majority receive a tax refund, and are very happy about it at that! I get it. I get the psychological win, but anyone can set up their withholdings in such a way to receive a tax refund, and in some cases a huge one. But is that the way to go? I do not believe so.

How should you fill out the W4 form and think about federal taxes when you start your residency?

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation.

I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay period. Your goal should be to have your total combined withholdings match your tax liability for the year as closely as possible, unless you are very financially disciplined. More on that in another post about owing vs. receiving money when you file federal taxes.