Displaying items by tag: investment

Where should you invest your next dollar?

Saving a lot of money as a Resident because you're not spending 50% of your take-home pay on rent? Making extra money because you're moonlighting like a boss and wondering where to save that extra money? Wondering whether a pre-tax or Roth investment is best to start investing in first? What about paying down loans or investing in the market? I describe how you should prioritize all of that in this post!

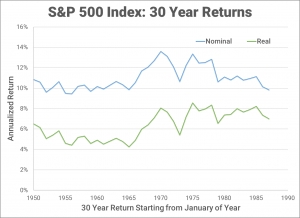

Should I pay my student loans first or invest in the market?

This is a common question that I get from my colleagues. To answer this question, I use a statistical approach to provide a conservative estimate of the threshold at which you would define as your "high-interest debt." If a loan has an interest rate higher than this, then you pay it down first. If the interest rate is lower, then you invest in the markets first.

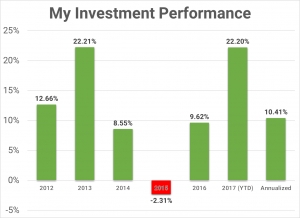

How to calculate your internal rate of return using Google Sheets

The internal rate of return (IRR) is the dollar-weighted return of a particular investment. It is what I consider to be gold standard measurement of your investment's personal performance. The calculation for IRR looks like a pain in the ass. Luckily, there is a spreadsheet function that calculates this easily for you, and I just so happen to be awesome at creating spreadsheets.

How diversifying your asset allocation smooths out the ride - a real life example

I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

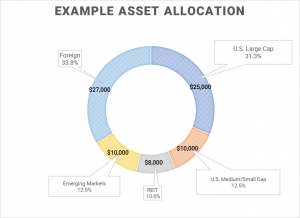

Achieving your target asset allocation across multiple accounts and investment vehicles

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!

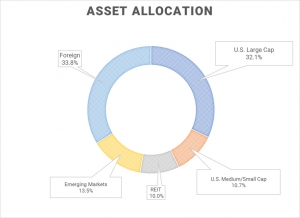

How to choose a target asset allocation for your investments

When it comes to choosing asset classes in your investment portfolio, most of us know that diversification leads to a better return vs risk profile by reducing volatility without sacrificing returns. That is the premise of investing in index funds instead of picking individual stocks. However, even among different index funds, depending on the asset class they represent, there can be high volatility as well (think emerging market or small cap funds). Thus, it is also important to diversify across different asset classes. I will show you my own personal asset allocation and how I decided on it.