Jerry H.

Why Should You Start Investing Immediately? The Magic Of Compound Interest

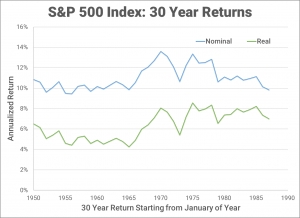

When it comes to compound interest, time could be your best friend... IF you start investing EARLY. The more time time you allow your investments to grow, the more they will compound and earn substantial returns. Many people forego investing for retirement while they are in training, with the rationale of: "I can start investing when I am an attending." I will show you why this thinking could potentially cost you millions of dollars in the future.

Before You Start Investing, You Should Create An Emergency Fund

What is an Emergency Fund? As the name implies, an emergency fund is specifically saved for an emergency. This could be due to many unforeseen circumstances, such as medical bills, a car malfunctioning, a pipe burst at home, etc. These can be very expensive bills that need to be paid in a relatively short time. Thus, your emergency fund needs to be (close to) immediately accessible. Another way to say this is that it needs to be liquid.

Introducing the Beginner Investor Educational Series

I will be creating a free educational series to teach YOU about the basics of investing your money and how to get started no matter if you have an initial investment of $1,000, $10,000, or more. The topics will be relevant to everybody who has just started working or is in the prime of their working lives. I may give specific examples that may be more relevant to Delayed Earners such as physicians.

How much money do you need to retire?

Gone are the days when people work until they turn 65, collect a pension, and retire. Employees used to be able to rely on their employer to take care of them so long as they spent a significant part of their working lives with that employer. Well, that rarely exists these days. Individuals can only rely on themselves to save and invest for their retirement.

Achieving Financial Independence By Forty

My thirst for early financial independence, also referred to as FIRE (Financial Independence Retire Early) by those in the personal finance world, probably started in 2014, as you will be able to tell from my savings rate that I will show you further down in this article. It started with rethinking my concept of money. The age old adage of retirement is to save 15-20% of your income, work until you turn 65, and then enjoy your life. But what if I don't want to start enjoying life when I turn 65? Can I do it as early as 55 years old? What about 45, or even 40 years old?

Guide to Rebalancing Your Portfolio

Rebalancing a portfolio is essential to maintaining the risk profile that you originally set for your portfolio, and can actually improve the performance of a portfolio compared to if you never rebalanced at all. This article discusses what it means to rebalance a portfolio, why you should do it, and how to do it.

What is Cash Drag and how do you minimize it?

Cash Drag is the nemesis of any long term portfolio, as it reduces returns and also has a large opportunity cost when not invested in something with better potential growth. Learn what cash drag is and four strategies to minimize it.

Guide to Opening a Backdoor Roth IRA

What if you are above the income limits to contribute to a Roth IRA? Ugh, right? Mo' money, mo' problems. You can't even get a tax deduction if you contribute to a traditional IRA! Fret not, for all is not lost. You CAN get a Roth IRA, and it's called the Backdoor Roth IRA.

Where should you invest your next dollar?

Saving a lot of money as a Resident because you're not spending 50% of your take-home pay on rent? Making extra money because you're moonlighting like a boss and wondering where to save that extra money? Wondering whether a pre-tax or Roth investment is best to start investing in first? What about paying down loans or investing in the market? I describe how you should prioritize all of that in this post!

Should I pay my student loans first or invest in the market?

This is a common question that I get from my colleagues. To answer this question, I use a statistical approach to provide a conservative estimate of the threshold at which you would define as your "high-interest debt." If a loan has an interest rate higher than this, then you pay it down first. If the interest rate is lower, then you invest in the markets first.