Displaying items by tag: personal finance

Why Should You Start Investing Immediately? The Magic Of Compound Interest

When it comes to compound interest, time could be your best friend... IF you start investing EARLY. The more time time you allow your investments to grow, the more they will compound and earn substantial returns. Many people forego investing for retirement while they are in training, with the rationale of: "I can start investing when I am an attending." I will show you why this thinking could potentially cost you millions of dollars in the future.

Before You Start Investing, You Should Create An Emergency Fund

What is an Emergency Fund? As the name implies, an emergency fund is specifically saved for an emergency. This could be due to many unforeseen circumstances, such as medical bills, a car malfunctioning, a pipe burst at home, etc. These can be very expensive bills that need to be paid in a relatively short time. Thus, your emergency fund needs to be (close to) immediately accessible. Another way to say this is that it needs to be liquid.

Introducing the Beginner Investor Educational Series

I will be creating a free educational series to teach YOU about the basics of investing your money and how to get started no matter if you have an initial investment of $1,000, $10,000, or more. The topics will be relevant to everybody who has just started working or is in the prime of their working lives. I may give specific examples that may be more relevant to Delayed Earners such as physicians.

My Financial Plan as an Attending

Finally! Training is over and now it is finally time to become an attending! All those years of training has enabled me to practice medicine without someone watching over my back (that part somewhat scares me!). Another benefit is a massive bump in salary, likely the biggest increase in salary I am going to see in my entire career. Getting off on the right foot financially has important implications for long term wealth and financial independence.

Guide to Opening a Backdoor Roth IRA

What if you are above the income limits to contribute to a Roth IRA? Ugh, right? Mo' money, mo' problems. You can't even get a tax deduction if you contribute to a traditional IRA! Fret not, for all is not lost. You CAN get a Roth IRA, and it's called the Backdoor Roth IRA.

How to calculate your internal rate of return using Google Sheets

The internal rate of return (IRR) is the dollar-weighted return of a particular investment. It is what I consider to be gold standard measurement of your investment's personal performance. The calculation for IRR looks like a pain in the ass. Luckily, there is a spreadsheet function that calculates this easily for you, and I just so happen to be awesome at creating spreadsheets.

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.

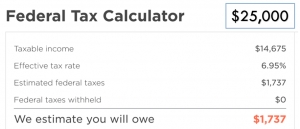

In 2011, when I started residency, the annual contribution limit to my 403(b) was $16,500, and the Roth IRA contribution limit was $5,000. You have until the end of the calendar year to contribute to the 403(b), whereas you have until April 15 of the following year to contribute to the Roth IRA (e.g. you have until 4/15/18 to contribute to 2017's Roth IRA). I wanted to contribute as much to my 403(b) as possible in this short time, with a limited salary. My gross salary for the year was approximately $25k, and I wanted to put $16.5k into my 403(b). That left a gross income of $7.5k, or approximately $6k after tax to live off of for six months. How can one live off of $6k for 6 months with a rent of close $925 a month? Turns out, it is really freaking hard.

How should you fill out the W4 form and think about federal taxes when you start your residency?

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation.

I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay period. Your goal should be to have your total combined withholdings match your tax liability for the year as closely as possible, unless you are very financially disciplined. More on that in another post about owing vs. receiving money when you file federal taxes.

Welcome to DelayedEarner.com

Welcome to my blog, DelayedEarner.com! What is a Delayed Earner, you might ask? Well, in a nutshell, that's me. Allow me to explain. My name is Jerry Hsieh, and I am a physician. I am finishing my fellowship in Pulmonary and Critical Care Medicine, and finally going out into the world to practice independently. Why do I call myself a Delayed Earner? Well, anyone who is familiar with the path of becoming a physician could probably tell you.