Displaying items by tag: roth ira

My Financial Plan as an Attending

Finally! Training is over and now it is finally time to become an attending! All those years of training has enabled me to practice medicine without someone watching over my back (that part somewhat scares me!). Another benefit is a massive bump in salary, likely the biggest increase in salary I am going to see in my entire career. Getting off on the right foot financially has important implications for long term wealth and financial independence.

Guide to Opening a Backdoor Roth IRA

What if you are above the income limits to contribute to a Roth IRA? Ugh, right? Mo' money, mo' problems. You can't even get a tax deduction if you contribute to a traditional IRA! Fret not, for all is not lost. You CAN get a Roth IRA, and it's called the Backdoor Roth IRA.

Where should you invest your next dollar?

Saving a lot of money as a Resident because you're not spending 50% of your take-home pay on rent? Making extra money because you're moonlighting like a boss and wondering where to save that extra money? Wondering whether a pre-tax or Roth investment is best to start investing in first? What about paying down loans or investing in the market? I describe how you should prioritize all of that in this post!

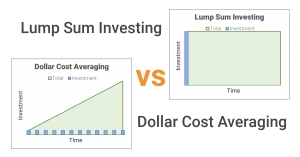

Dollar Cost Averaging is CRAP!

Dollar cost averaging (DCA) is a type of investment strategy where an investor will make constant dollar amount contributions to an investment at regular intervals. This theoretically reduces the risk and smooths out your purchase price over the course of time that you are contributing. The idea is that you are buying more shares of an investment when the price is low, and less shares when the price is high. I will show you that Lump Sum investing is superior to DCA investing using historical data of the S&P 500.

How diversifying your asset allocation smooths out the ride - a real life example

I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

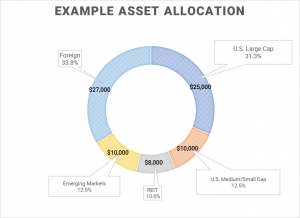

Achieving your target asset allocation across multiple accounts and investment vehicles

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.

In 2011, when I started residency, the annual contribution limit to my 403(b) was $16,500, and the Roth IRA contribution limit was $5,000. You have until the end of the calendar year to contribute to the 403(b), whereas you have until April 15 of the following year to contribute to the Roth IRA (e.g. you have until 4/15/18 to contribute to 2017's Roth IRA). I wanted to contribute as much to my 403(b) as possible in this short time, with a limited salary. My gross salary for the year was approximately $25k, and I wanted to put $16.5k into my 403(b). That left a gross income of $7.5k, or approximately $6k after tax to live off of for six months. How can one live off of $6k for 6 months with a rent of close $925 a month? Turns out, it is really freaking hard.