Displaying items by tag: 401(a)

How diversifying your asset allocation smooths out the ride - a real life example

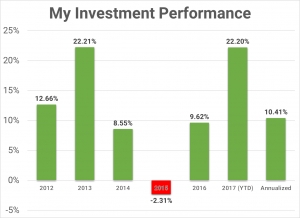

I have talked before about diversifying your portfolio by targeting an asset allocation that is right for you. I also recommended a way to balance it across multiple accounts, with the goal of keeping as few funds in each account as you can. When you do this, each account by itself is NOT very diversified, and subject to a relatively large amount of volatility. However, if you take ALL of the accounts together, the overall volatility decreases without much sacrifice in the performance.

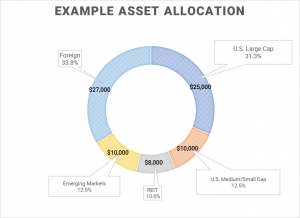

Achieving your target asset allocation across multiple accounts and investment vehicles

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!