Displaying items by tag: 403(b)

Why Should You Start Investing Immediately? The Magic Of Compound Interest

When it comes to compound interest, time could be your best friend... IF you start investing EARLY. The more time time you allow your investments to grow, the more they will compound and earn substantial returns. Many people forego investing for retirement while they are in training, with the rationale of: "I can start investing when I am an attending." I will show you why this thinking could potentially cost you millions of dollars in the future.

Where should you invest your next dollar?

Saving a lot of money as a Resident because you're not spending 50% of your take-home pay on rent? Making extra money because you're moonlighting like a boss and wondering where to save that extra money? Wondering whether a pre-tax or Roth investment is best to start investing in first? What about paying down loans or investing in the market? I describe how you should prioritize all of that in this post!

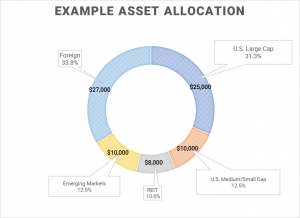

Achieving your target asset allocation across multiple accounts and investment vehicles

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!

An argument for owing federal taxes instead of receiving a tax refund

If given the following options, which would you choose? Would you rather...

- offer the federal government an interest-free loan for up to 16 months, or

- receive an interest-free loan from the government for up to 16 months.

The heart of this choice is played out every year, when individuals choose their allowances on their W4 form which determines how much taxes to defer for federal taxes. Withhold more than you owe - you will get a tax refund. Withhold less than you owe - you will have to pay the amount owed. Every year when it comes time to file taxes, I like to ask people whether they owe taxes or are receiving a tax refund. It seems a majority receive a tax refund, and are very happy about it at that! I get it. I get the psychological win, but anyone can set up their withholdings in such a way to receive a tax refund, and in some cases a huge one. But is that the way to go? I do not believe so.

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.

In 2011, when I started residency, the annual contribution limit to my 403(b) was $16,500, and the Roth IRA contribution limit was $5,000. You have until the end of the calendar year to contribute to the 403(b), whereas you have until April 15 of the following year to contribute to the Roth IRA (e.g. you have until 4/15/18 to contribute to 2017's Roth IRA). I wanted to contribute as much to my 403(b) as possible in this short time, with a limited salary. My gross salary for the year was approximately $25k, and I wanted to put $16.5k into my 403(b). That left a gross income of $7.5k, or approximately $6k after tax to live off of for six months. How can one live off of $6k for 6 months with a rent of close $925 a month? Turns out, it is really freaking hard.