Displaying items by tag: retirement

Why Should You Start Investing Immediately? The Magic Of Compound Interest

When it comes to compound interest, time could be your best friend... IF you start investing EARLY. The more time time you allow your investments to grow, the more they will compound and earn substantial returns. Many people forego investing for retirement while they are in training, with the rationale of: "I can start investing when I am an attending." I will show you why this thinking could potentially cost you millions of dollars in the future.

How much money do you need to retire?

Gone are the days when people work until they turn 65, collect a pension, and retire. Employees used to be able to rely on their employer to take care of them so long as they spent a significant part of their working lives with that employer. Well, that rarely exists these days. Individuals can only rely on themselves to save and invest for their retirement.

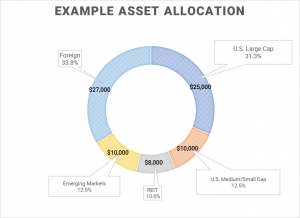

Achieving your target asset allocation across multiple accounts and investment vehicles

Trying to achieve your target asset allocation across multiple accounts can be quite difficult. It can feel even more so when you consider that each investment vehicle has its own tax consequences. For instance, you may own pre-tax investment accounts, which can include your 401(k), 403(b), individual 401(k), and traditional IRA. You might also own post-tax investment accounts, so called 'Roth' accounts which include the Roth IRA and Roth 401(k) or 403(b) accounts. If all of these are maximized, you may also start placing investments in a taxable brokerage account, like I do. You start accumulating a lot of investment vehicles and it can feel impossible to achieve your target asset allocation. I will show you how to overcome this!

Why I preferentially choose 1099 income over W-2 income

Having 1099 income in addition to W-2 income provides you with a lot of flexibility in terms of retirement accounts and tax deductions. Prior to diving deeper into this topic let me explain that I do already have a day job that is W-2 income and provides all the benefits you would expect, including health and disability insurance, retirement benefits, etc. My preference in choosing 1099s over W-2s is with regards to additional income outside of my day job.