My thirst for early financial independence, also referred to as FIRE (Financial Independence Retire Early) by those in the personal finance world, probably started in 2014, as you will be able to tell from my savings rate that I will show you further down in this article. It started with rethinking my concept of money. The age old adage of retirement is to save 15-20% of your income, work until you turn 65, and then enjoy your life. But what if I don't want to start enjoying life when I turn 65? Can I do it as early as 55 years old? What about 45, or even 40 years old?

With a large income, a large savings rate, and a modest spending rate, then it is totally achievable. When the daily fluctuations of your investments exceed what you make in a day (especially in the positive direction), you start wondering what could happen if you toss as much money as you can into investments.

What is Financial Independence?

For me, financial independence means that my and my wife's investments by themselves are capable of supporting our lifestyle for the rest of our lives without needing to work. Ideally, the appreciation and cash flow generated will be enough to sustain us indefinitely without the investments diminishing in value over time.

It does not necessarily mean that I will stop working, but does mean that I have the freedom to choose what, how, and when I want to work. I think this kind of freedom is one of the most important things to strive for, as it preserves the most valuable commodity in our lives, time. If I want to travel for 2 months at a time in between working 2 months at a time, I could do that. If I want to pursue a side hustle (i.e. this blog) full time, I could do that! The options are wide open when you have financial independence.

My Personal Savings Rate

Below is a chart of my and my wife's yearly savings rate as a percentage of income since we started our residencies in 2011 and 2012, respectively. You may remember that I tried to max out my 403(b) retirement account in my first half year of internship, which led to an amazing savings rate! However, it also left me with a scarcity mindset, so the next two years I pretty much slacked off with the savings. 2014 is when I opened my individual 401(k) account, which coincided with my realization that FIRE is possible. I am not suggesting that opening the individual 401(k) account is the reason that I saved so much, but it certainly gave me another avenue to save on a tax-advantaged basis. 2014-2015 is also around the time that my moonlighting income blew up. Obviously, when you make a lot more money, it is much easier to save a lot more as long as you don't succumb to lifestyle inflation. It is also nice of my wife to let me invest her money as well.

Savings Rate by Year

How I Calculated My Savings Rate

This will get technical, so skip to the next section if you'd like. First of all, I only consider money that is invested in something other than cash as "savings." Holding a lot of cash leads to cash drag, so another objective of mine is to keep as little money in cash as I can. Secondly, paying down debts, loans, and mortgages should also be considered savings on an after-tax basis. As of this writing, I have no assets other than retirement accounts and taxable brokerage accounts, which makes this calculation much simpler. If you have a mortgage, I would consider the payments that go to principal as improving your net worth. Here are the steps I took to calculate a savings rate:

- In a given year, sum up all contributions to pre-tax investments (e.g. 401k, 403b).

- Sum up all contributions to after-tax investments (e.g. Roth, taxable brokerage, loans/debts).

- Sum up all take-home pay. Your last paycheck of the year is very useful for this. If a portion of this is 1099 income, then you want to add your net profits as shown on your federal tax return instead of the gross income.

- Calculate your savings rate with the following equation using the numbers 1-3 corresponding to the items above: (1+2)/(1+3)

For 2017 (YTD), the savings rate is actually underestimated because I use my gross 1099 income instead of the net profits to calculate #3 since I don't know my net profits yet. Why is 2017 so high despite the underestimation? Because I was very cash heavy in 2016 going into 2017, at which point I had extra cash to put into "savings."

When Can I Become Financially Independent?

To summarize my situation, here is what I have going for me:

- I have a positive net worth at present

- In recent years, I have been saving at a rate of about 55%

- I do not plan to inflate my lifestyle (except for the inevitable increase in rent costs of moving from Delaware to California)

- My income will increase by about 50%

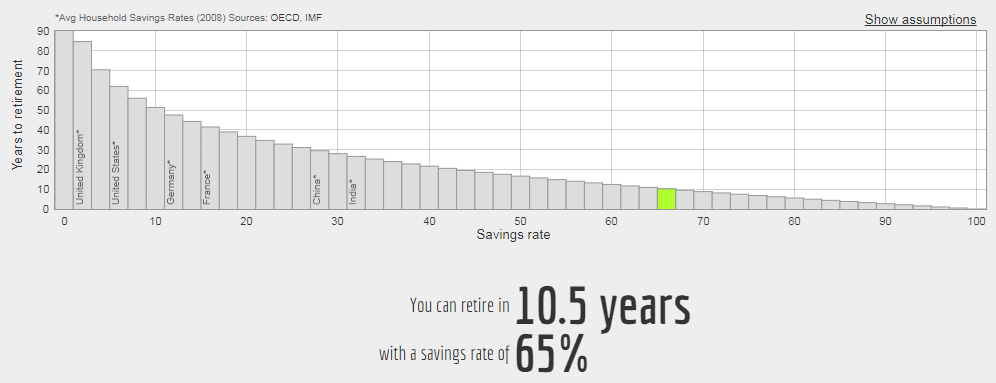

With a higher income and not succumbing to lifestyle inflation, my savings rate can reasonably increase to 65% or more. If I maintain a savings rate of 65%, how long will it take for me to retire? A simplified calculation from networthify says:

This estimation is starting from a net worth of zero. Considering my net worth is positive, then I am at least partway through the 10.5 years. So can I do this by 40 years old? I think so!