Thursday, 22 June 2017 14:20

Life Hacks - a scheduling tool for adding work shifts onto your Google calendar

Written by Jerry H.

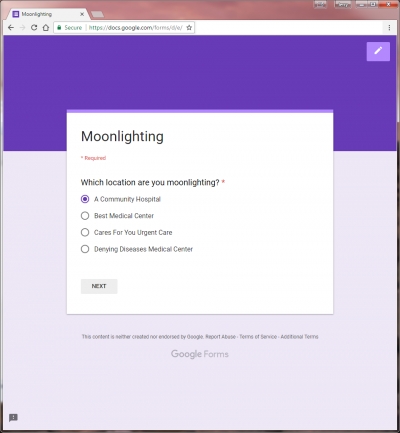

Do you ever get tired of manually putting in work shifts onto your calendar? Do you work a sporadic schedule where you often have multiple shifts a month, but the days are not neatly arranged? Do you moonlight a lot, like I do,and need an easy way to put all those shifts onto your calendar? If so, continue reading to learn about how I solved this problem for myself. I can even help you do the same.

Published in

Moonlighting

Sunday, 29 November -0001 16:00

How I increased my moonlighting income from a few thousand dollars a year to six figures!

Written by Jerry H.

This is the story of my moonlighting journey for the past five years. It included a lot of hustling to find more shifts, a manageable workload, and better paying jobs. How much can you make moonlighting as a physician in training? In the past five years, I went from making a few thousand dollars a year to breaking six figures. Read more to find out my strategies and how you can do the same.

Published in

Moonlighting

Monday, 19 June 2017 08:16

What are the tax implications of receiving 1099 income?

Written by Jerry H.

Just as a refresher, W-2 income is generally the payment type when you are an employee while 1099 is the payment type when you are an independent contractor. The fundamental difference between receiving 1099 income and W-2 income in the purview of the federal government is the distinction between being employed or self-employed. There are some major differences in tax calculations and how taxes are paid, which I plan to discuss in the rest of this post.

Published in

Moonlighting

Tuesday, 20 June 2017 12:08

Why I preferentially choose 1099 income over W-2 income

Written by Jerry H.

Having 1099 income in addition to W-2 income provides you with a lot of flexibility in terms of retirement accounts and tax deductions. Prior to diving deeper into this topic let me explain that I do already have a day job that is W-2 income and provides all the benefits you would expect, including health and disability insurance, retirement benefits, etc. My preference in choosing 1099s over W-2s is with regards to additional income outside of my day job.

Published in

Moonlighting

Saturday, 17 June 2017 14:11

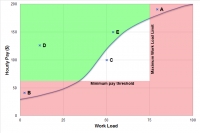

What are my considerations when choosing a moonlighting job?

Written by Jerry H.

I have a reputation among the residents and fellows at my hospital as being a moonlighting guru -- I think the reason is that they hear that I moonlight a lot, so they think I must know a lot about it! They often ask me for advice on how to get started and what I look for in a moonlighting gig, so I decided to write this post describing my thought process when evaluating a moonlighting gig.

Published in

Moonlighting

Saturday, 17 June 2017 07:08

Avoiding underpayment penalties for federal taxes - the safe harbor rule

Written by Jerry H.

As a proponent of owing federal taxes during filing season as opposed to receiving a refund, I have to be wary to avoid penalties for underpaying taxes along the way. Federal taxes are meant to be a 'pay as you earn' system where you should be "safe harbor" tax law, which are the conditions I need to satisfy in order to NOT owe penalties for underpayment. These can be found in chapter 4 of Publication 505 of the IRS website, which I will describe in more detail in this post.

Published in

Taxes

Page 4 of 5