Rebalancing a portfolio is essential to maintaining the risk profile that you originally set for your portfolio, and can actually improve the performance of a portfolio compared to if you never rebalanced at all. This article discusses what it means to rebalance a portfolio, why you should do it, and how to do it.

Published in

Investing

Cash Drag is the nemesis of any long term portfolio, as it reduces returns and also has a large opportunity cost when not invested in something with better potential growth. Learn what cash drag is and four strategies to minimize it.

Published in

Investing

What if you are above the income limits to contribute to a Roth IRA? Ugh, right? Mo' money, mo' problems. You can't even get a tax deduction if you contribute to a traditional IRA! Fret not, for all is not lost. You CAN get a Roth IRA, and it's called the Backdoor Roth IRA.

Published in

Investing

Saving a lot of money as a Resident because you're not spending 50% of your take-home pay on rent? Making extra money because you're moonlighting like a boss and wondering where to save that extra money? Wondering whether a pre-tax or Roth investment is best to start investing in first? What about paying down loans or investing in the market? I describe how you should prioritize all of that in this post!

Published in

Investing

Wednesday, 05 July 2017 05:00

Should I pay my student loans first or invest in the market?

Written by Jerry H.

This is a common question that I get from my colleagues. To answer this question, I use a statistical approach to provide a conservative estimate of the threshold at which you would define as your "high-interest debt." If a loan has an interest rate higher than this, then you pay it down first. If the interest rate is lower, then you invest in the markets first.

Published in

Investing

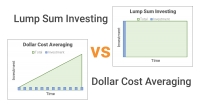

Dollar cost averaging (DCA) is a type of investment strategy where an investor will make constant dollar amount contributions to an investment at regular intervals. This theoretically reduces the risk and smooths out your purchase price over the course of time that you are contributing. The idea is that you are buying more shares of an investment when the price is low, and less shares when the price is high. I will show you that Lump Sum investing is superior to DCA investing using historical data of the S&P 500.

Published in

Investing

Page 2 of 3