Displaying items by tag: w4

How should you fill out the W4 form and think about federal taxes when you start your residency?

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation.

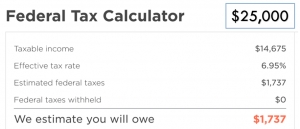

I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay period. Your goal should be to have your total combined withholdings match your tax liability for the year as closely as possible, unless you are very financially disciplined. More on that in another post about owing vs. receiving money when you file federal taxes.