This post is meant to describe what moonlighting is for a physician and why you should do it. It is generally something that can be started during training as a resident, and can continue through fellowship and even as an attending. It will be important to check the terms of your employment to make sure it is allowed. Also, for those in training, be sure to stay within the ACGME duty hours.

Published in

Moonlighting

Tuesday, 13 June 2017 07:14

An argument for owing federal taxes instead of receiving a tax refund

Written by Jerry H.

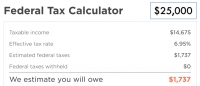

If given the following options, which would you choose? Would you rather... offer the federal government an interest-free loan for up to 16 months, or receive an interest-free loan from the government for up to 16 months. The heart of this choice is played out every year, when individuals choose their allowances on their W4 form which determines how much taxes to defer for federal taxes. Withhold more than you owe - you will get a tax refund. Withhold less than you owe - you will have to pay the amount owed. Every year when it comes time to file…

Published in

Taxes

Sunday, 11 June 2017 16:16

My attempt to max out my 403(b) retirement account in the first (half) year of residency

Written by Jerry H.

Prior to starting internship and residency, I knew that I had a shortened time frame of 6 months in which to contribute to my 403(b)/401(k), since I would only start earning a salary around July 1 of that year. I also knew that residency would likely be the only time in my career that I would be able to contribute to a Roth IRA (other than the backdoor Roth IRA that I later learned about) and so I definitely wanted to max that out as well. The only problem with such lofty goals is where the money would come from.…

Published in

Investing

Saturday, 10 June 2017 13:39

How should you fill out the W4 form and think about federal taxes when you start your residency?

Written by Jerry H.

From a taxation perspective, starting residency is no different from starting any other salaried employment. What is pretty much a universal truth about residency is that they all start on or around July 1. Anyone who is starting employment in the middle of the calendar year can apply what I discuss below to their situation. I am writing this article because I want to provide a framework for thinking about federal taxes and how to estimate the amount you will owe. The W4 form instructs your employer to automatically withhold a certain amount of money from your paycheck each pay…

Published in

Taxes

Welcome to my blog, DelayedEarner.com! What is a Delayed Earner, you might ask? Well, in a nutshell, that's me. Allow me to explain. My name is Jerry Hsieh, and I am a physician. I am finishing my fellowship in Pulmonary and Critical Care Medicine, and finally going out into the world to practice independently. Why do I call myself a Delayed Earner? Well, anyone who is familiar with the path of becoming a physician could probably tell you.

Published in

Miscellaneous

Page 5 of 5